We’re going to be chatting about all this stuff at our workshop this coming Sunday & Monday – but I’ve gotten so many emails & text messages about this recently (since tax time is looming around the corner) that I thought I’d write a post here as well! I know all this money and tax talk can be no fun if you’re a self-employed person… long gone are the days of tax refunds that you could spend carelessly on a vacation or shopping spree! But – you can still make tax time work for you without all the stress and worry! Here’s how!

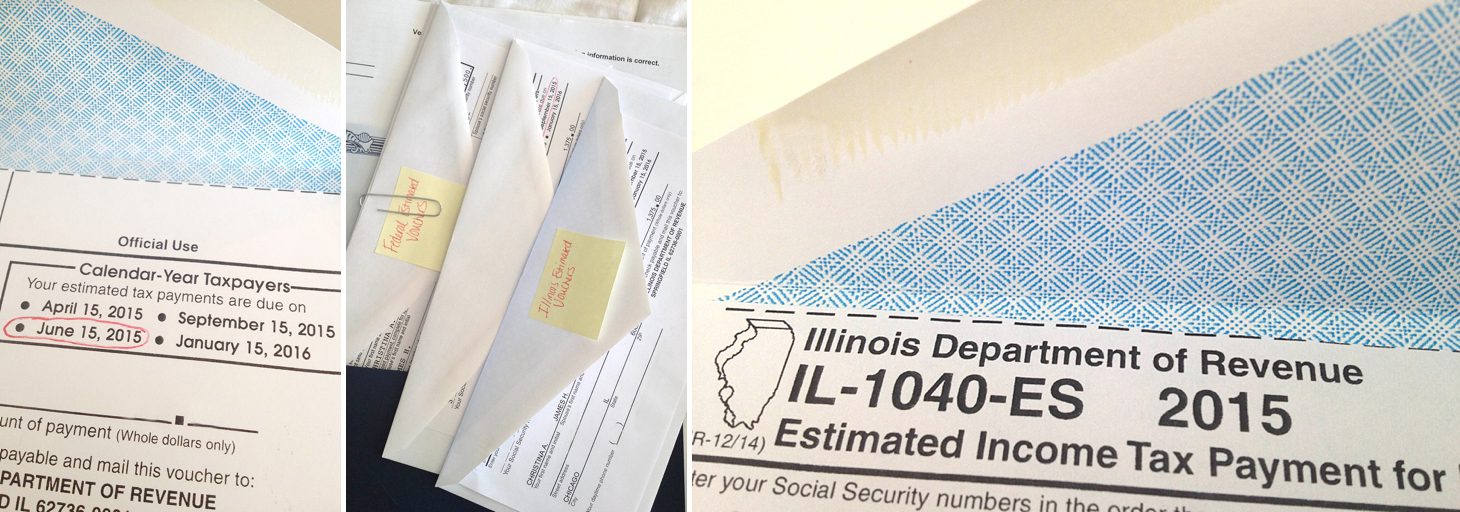

If you’re a full-time photographer you should be paying Estimated Quarterly Income Tax Payments throughout the year to both your state and the federal government (if your state has income tax, that is. I know some of you lucky ducks don’t!). The amount you send in is determined by your past year’s income and taxes. (In my opinion: You need an accountant for this! Our accountant handles all this information and sends us vouchers & addressed envelopes for each payment so we know exactly when and where to send in our payments.)

That being said – if the estimates are based on your last year’s income they may not be accurate for your current year’s income! Obviously the goal in running any small business is to continue to grow and become more profitable each year. Therefore, it goes without saying, that you are hopefully making more money each year than you did the last, which also means you’re going to owe more in taxes than you did the past year. If you don’t plan appropriately you’ll come to tax time and realize you owe a handful (or lots more) of money you did not appropriately save! Yikes!!

Our solution to this is the following:

1. We divide our quarterly payments by 3 so we know how much we need to save for our estimated tax payments each month. We put that amount of money into our business savings account at the start of the month. Then when the due date nears for each quarterly payment, we pull that money out and mail the checks in to the government.

2. At the end of each month we log in to our Mint.com account (where we track all our business income & expenses) and see what our gross income is for the year so far. (Gross Income is the TOTAL amount we brought in. This doesn’t take into account any expenses or anything like that!) Then I divide that gross income number by 4 (to figure out what 25% taxes would be on our income).

3. I take that 25% of Gross Income number and subtract what we have already paid/saved for in estimated quarterly taxes so far. The difference between those numbers is the ADDITIONAL amount I put into our business savings on top of our estimated quarterly taxes. That way when the year comes to an end, I have extra money in our business savings based on what we could owe on our additional income for the current year!

4. It is also important to remember that at the same time taxes are due for the prior year (April 15th) is also when your 1st quarter estimated tax payment is due for the new year!! So if you made more money in 2014 than you did in 2013 (using this year as an example) – then your 2015 1st quarter estimated tax payment will be higher than your previous year’s estimated quarterly payments as well. In order to account for what we may owe for first quarter estimated for 2015 I took our total gross income for 2014, divided it by 4 (again to get that 25% tax number), and then divided by 4 again (to get what the first quarter estimate might be). Then I made sure we had that amount in savings as well as the extra savings we had for 2014!

All written out in words this can be confusing – so below is a number example to give you a more concrete idea!!!

(Let’s say your estimated quarterly tax payments for 2014 were $7,500 per quarter and use that to do all the calculations.)

Based on that number, we would want to save $2,500 per month towards our estimated tax payment (each quarter is 3 months, so divide your estimated payments by 3 to get monthly).

Let’s say we get through May (5 months into the year) and check on our gross income (as noted in #2 above) and see that we have made $70,000 so far.

$70,000 / 4 = $17,500 (what we could owe at 25% tax on our gross income)

Since we have been saving/paying $2,500 a month based on our quarterly estimated tax payment – that means through May we have paid/saved $12,500 in income tax.

$17,500 (what we could owe based on our new income)

– $12,500 (what we saved/paid so far)

$5,000 (the additional amount we should put in savings for what we could owe at the end of the year)

Do this check-up each month to stay on track with your savings based on your income!

Then let’s say we come to year end and we have been appropriately saving each month for how much extra income we brought in (as noted above).

We calculated to realize our total gross income for 2014 was $200,000.

$200,000 / 4 = $50,000 (25% tax based on our new gross income)

$50,000 (estimate of what we could owe based on current gross income at 25% tax)

– $30,000 (amount we paid in estimated quarterly taxes in 2014 – $7,500 each quarter)

$20,000 (what we could owe on top of our estimated payments, and should have saved throughout the year based on our new income)

Then to figure out what you could owe for the first quarter estimated tax payment for the new year (2015):

Take the 25% tax estimate you calculated ($50,000) based on your current gross income and divide by 4 (to get a quarterly estimate) = $12,500.

So on top of what you could owe for 2014 prior year ($20,000), your new estimated tax payment for 2015’s first quarter (also due on April 15th) could be $12,500. Therefore you want to make sure you have saved $32,500 total (on top of what you already paid in estimated quarterly taxes for the year) to ensure you have enough savings for taxes you may owe.

The good news is that in all our years doing this full-time (with no other family income other than from photography) – our taxes have never been higher than 20% of our gross income!! Which means that based on the numbers and calculations above – that we have more than enough money saved when tax time comes and can use the extra savings to carry over into the new year, transfer some to our personal savings account, or use some to do something fun!! That way we aren’t scrambling when tax time comes and afraid we won’t have enough money to cover what we may owe.

Obviously – this is just how we do things and I always encourage people to TALK TO THEIR ACCOUNTANT about the best course of action within your state and for your specific business!!

Please feel free to comment below with any questions, or shoot me an email!

. . . .

*Disclaimer: The information contained in this site is for general guidance only. The application and impact of tax laws can vary widely based on states and individual businesses. Accordingly, the information on this site is provided with the understanding that the author is not engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers.